Momentum Mastery Newsletter #4

Market outlook, focus lists , and portfolio updates

Dear Reader ,

Welcome back to the Momentum Mastery newsletter. I hope you are doing well.

Strength in the market continued this week as well with indexes making new all time highs and number of stocks making new highs continuously increasing.

Breakouts are sustaining and having good follow throughs. As market is making new highs , sentiment is also getting better.

Market Update

CNX500

After a big range week the previous week , Nifty500 made a new All Time High this week as well.

However index had a big reversal on Friday after making new highs early in the session index had a big reversal and closed negative and below the low of the previous day.

On the weekly the index closed positive but had a narrow range spread and closing range was also weak.

Price above all KMAs on the weekly as well as on the daily.

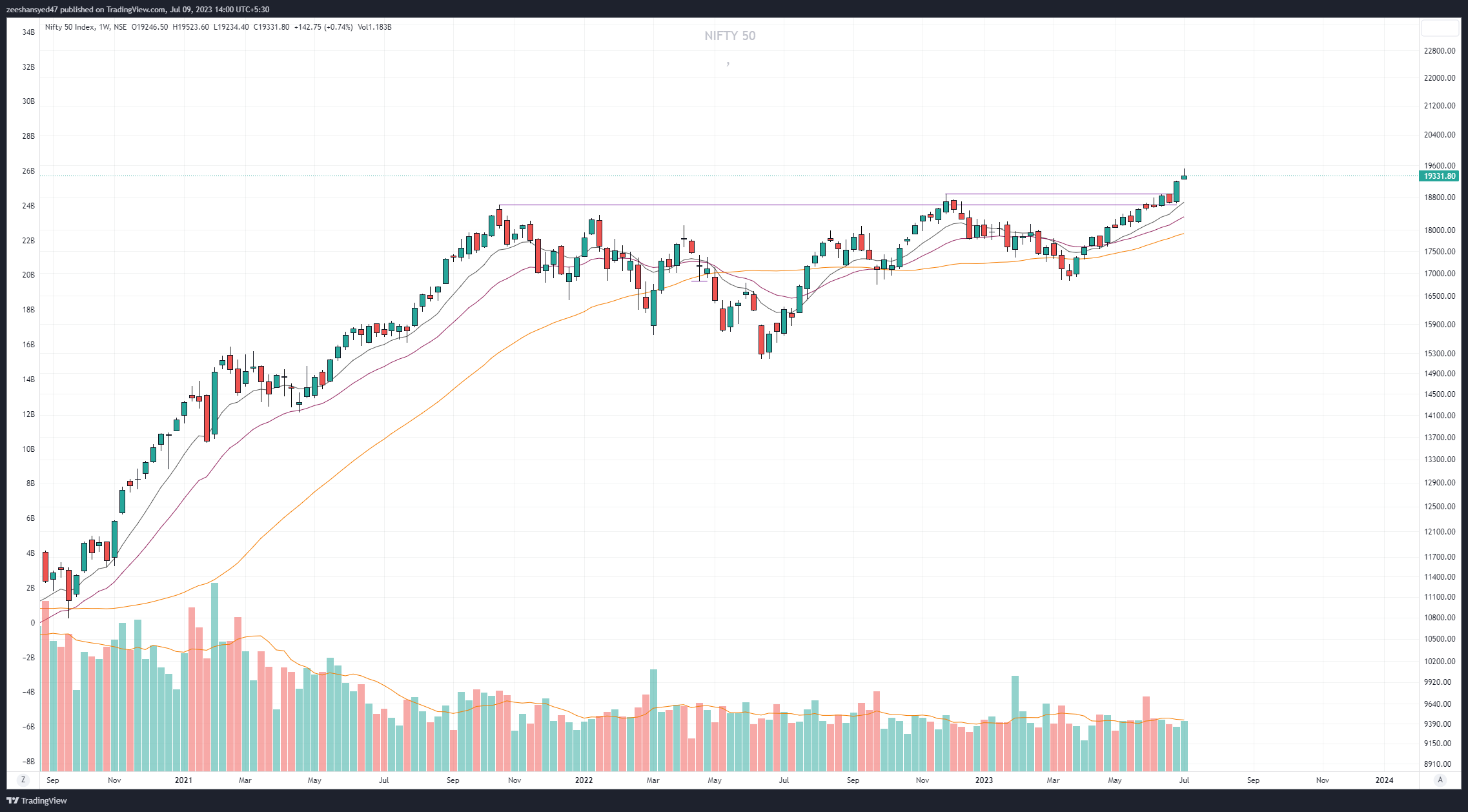

Nifty50

Following a big range breakout last week , the Nifty 50 index made a new ATH this week as well.

Similar to the Nifty 500 index, Nifty50 had a big reversal on Friday after making new highs early in the session index had a big reversal and closed negative and below the low of the previous day.

Closing range was very weak on the weekly and index closed in a narrow range forming a doji candle.

All KMAs on the weekly and daily timeframe trending up

Nifty Midcap 100

The Midcap index made a new high and closed positive for the week forming a narrow range doji candle

Index had a big reversal day on Friday closing negative.

All KMAs on the weekly and daily timeframe trending up.

Nifty Smallcap 100

The smallcap index showed good strength this week with index having a good range breakout and cloing near 52w highs.

Index had a big range week on the weekly as well as closing in the upper half of the range

Opened the week with a big gap up and followed with multiple big range days.

Comfortably trading above all weekly KMAs.

Market Breadth

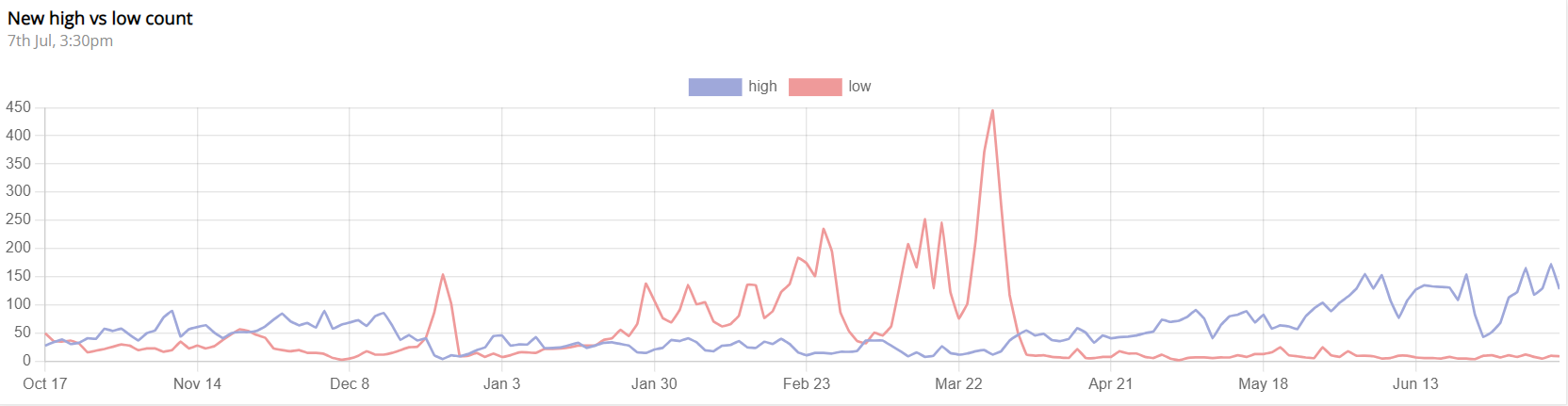

Net New Highs/Lows

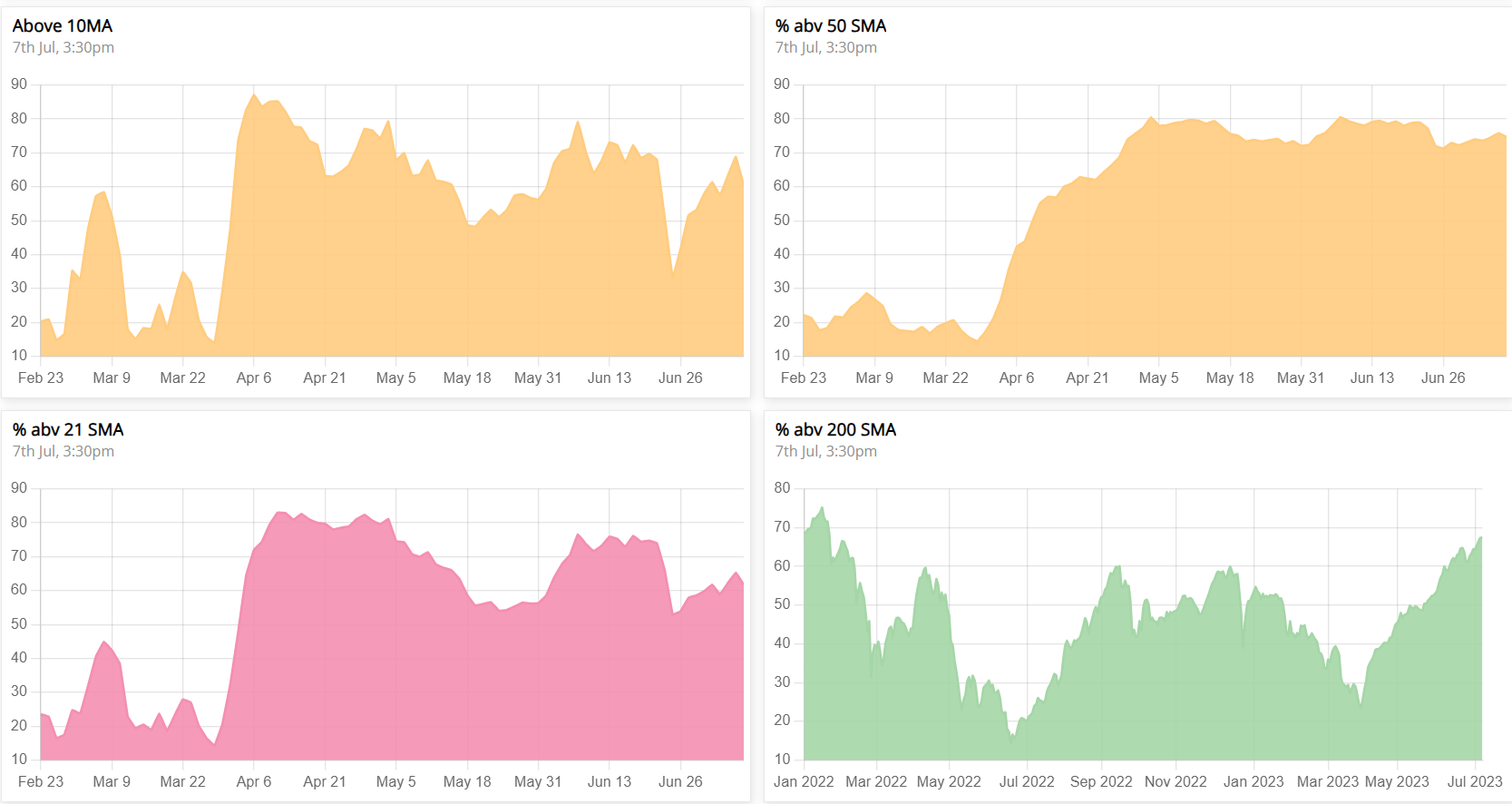

Stocks above 10/21/50/200 MA

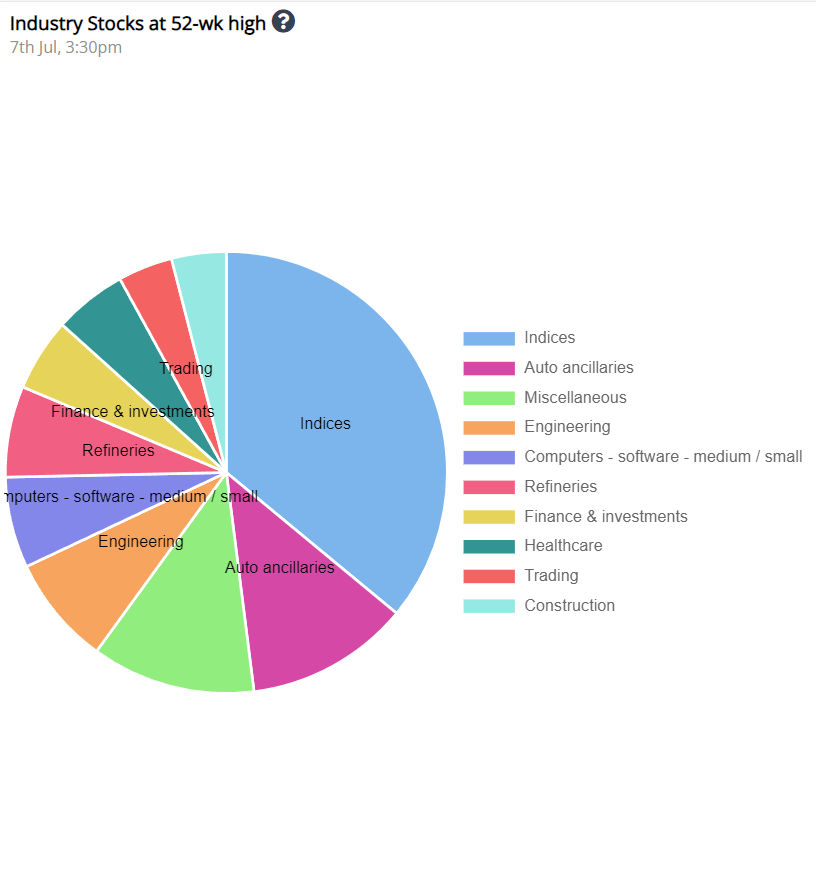

52w high Industry groups

Outlook: POSITIVE

After a big range last week all the major indices made new highs. However on Friday after making new highs, market reversed and closed negative.

Most of the indices had narrow range weeks and had poor closing range except for the smallcap index which had a strong weekly close.

All indexes are comfortably trading above their 10, 21,50 and 200ema.

The trend in Net New Highs/Lows continues to pick strength after closing 100+ continuously for the week.

Number of stocks above their 200dma trending higher close to 70%.

Nasdaq and S&P500 also had negative weeks but are clearly in an uptrend

The number of stocks making new highs are continuously increasing with many more sectors participating. Increasing number of breakouts are sustaining.

We are very well in an Up trending market with Indices making new All time highs and closing strongly and trading above all KMAs.

After the big range last week, indices had a narrow range week. Watching Breakout on either side will be crucial to form an idea about the short term trend. The medium term trend is still on the upside.

Market is still in an uptrend with all KMAs trending higher and above each other. However we seem to be a little extended from the 10w MA and might enter into a consolidation phase and let the longer term KMAs catch up and try to build a base.

Multiple sectors like Auto, Auto ancillaries, Small IT, Banks and finance , engineering showing strength. Leading stocks from these sectors are performing very well.

However many of the leading stocks have run up a lot and are extended to give fresh entries.

After going through hundreds of charts this weekend, I can almost surely say that the best of the leading stocks have already broken out and many of them are in extended territory.

The stocks that are breaking out now are laggards , after the market has already broken out several weeks earlier. It would be wise not to chase them aggressively.

We are trying to come out of a almost two year of bear market and a multi-week consolidation near the highs would be good for the market and also for finding the next set of leaders in the market.

TOP 20-25 STOCKS FOCUS LIST

Please note that these stocks are not recommendations but are some stocks that I am closely watching and holding in my portfolio

Also most of the stocks in the above list have run up a lot in recent weeks and it would be wise to wait for your setups before taking any action.

Portfolio Updates

Most of the portfolio held up well despite weakness in the market towards the end.

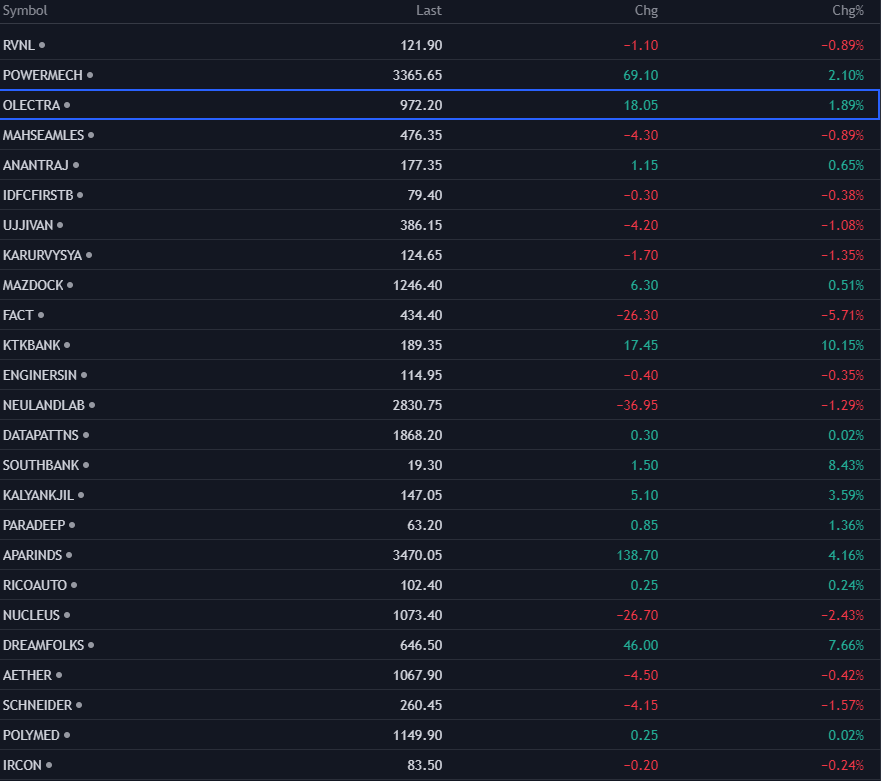

Big gains in PowerMech and Olectra helped the portfolio in holding up the gains.

Have not added a new position in last several weeks. However have reduced a couple of them.

It has been solid couple of months for the market and we are well positioned in some of the leading stocks. We have just had a breakout in the indices after a long sideways and choppy market. Hoping we get a multi-month trending market so that we can make the most of it. Stay Positive.

Thank you so much for reading the Momentum Mastery newsletter. Take care and see you soon.

Regards,

Zeeshan Syed.

Good article